Mixing up cooking and retro decor, recipe tips, retro kitchen art & decor, cool recipes and funny cooking sayings for much longer than I should say

Welcome to my re-do! How do like my new look? A Super-Duper-Sized Thanks for dropping by! — Love, Mom

Quickie Links to Your Favorite Recipes and Tips Pages

Mom’s Recipes: Biscuits For One or Two

Mom’s Recipes: Biscuits For One or Two

MomsRetro Easy No Milk, No Egg, No Butter Biscuits for One or Two This is a simple vegetarian, eggless, milkless biscuit recipe you can whip up in your toaster oven!

Chocolate Baking Recipe Substitutions and Tips

Chocolate Baking Recipe Substitutions and Tips

Mom helps cooks and chocoholics with recipe substitutions and tips for baking with chocolate, plus the world’s easiest dipped strawberry recipe!

Sauce Recipe Tips and Substitutions

Sauce Recipe Tips and Substitutions

Adapting recipes from antique cookbooks can also cause confusion. What is arrowroot and must I consult a wizard? Mom helps with sauce recipe substitutions for milk, cream, buttermilk and other sauce ingredients like arrowroot and cornstarch

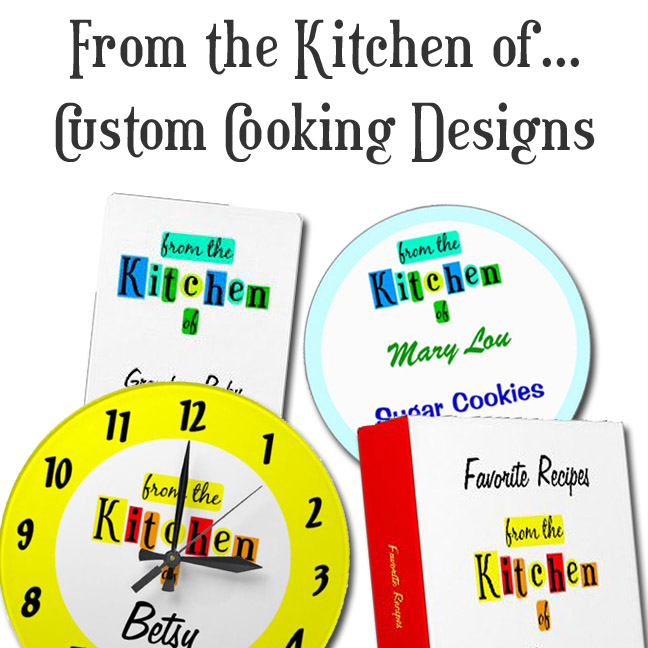

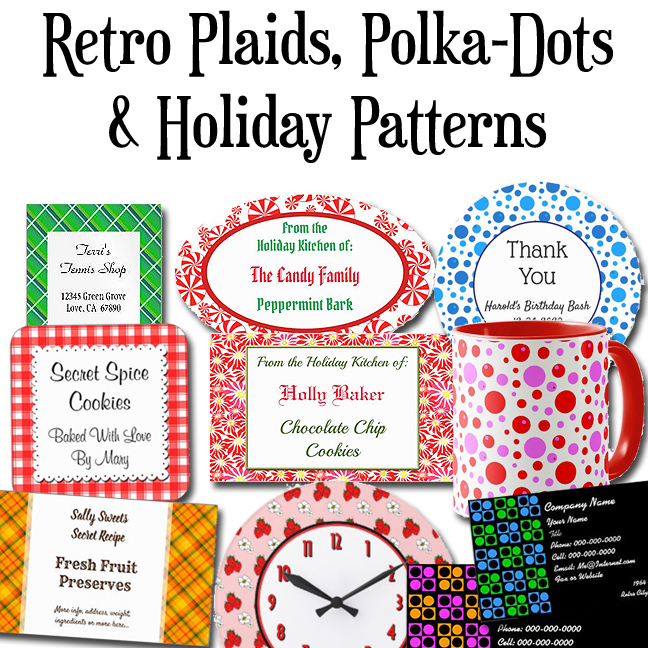

My Retro Kitchen Art Collection of Custom Designs

This is where I cook up my food and cooking designs funny kitchen slogans for my online stores. Inspired by actual kitchen events! Here’s what Mom is serving up at Mom’s Retro Kitchen Art Store: Mom has her own cooking and retro kitchen art store on Zazzle! What does this mean for you? You can now personalize any design! All my designs come on custom canning labels, totes, aprons, T-shirts, art cards, business cards, new travel mugs and other fun products.

Retro Plaids, Polka Dot and Holiday Patterns for Kitchens or Home Fun plaids, polka-dots and retro kitchen patterns on baking stickers, mugs, towels, kitchen decor and more |

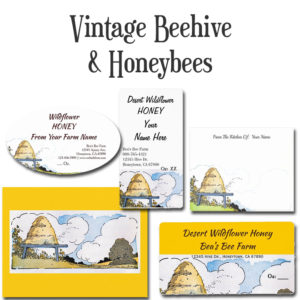

Vintage Beehive Happy Bees Designs Beautiful restored antique landscape art of a straw beehive on a hill on a cloudy day |

MomsRetro Custom Fruit and Vegetable Crate Label ArtEditable fruit and vegetable designs based on vintage crate labels |

BBQ Grill King and Queen Sayings A fun cookout design with red flames and smoldering letters. For cooks and cookout chefs on custom canning stickers, aprons and invitations |

|

My retro kitchen girl is a magician in the kitchen! She’s wearing a top hat, red dress and yellow polka dot apron, her spoon sprinkles sparkles onto the retro lettering. |

Create your own custom canning, baking or recipe labels with these cute retro designs reading “From the Kitchen of” on blocks of color. |

Favorite Foods Vintage Kitchen ArtFeaturing bread, butter, meat, potato, milk, apple and egg. Art restored and colored by hand comes on custom canning labels, recipe binders and more |

For mom’s who drive the kids and serve up love from the kitchen on Mother’s Day or any day! |